Factor Screening + In-Depth Fundamental Analysis

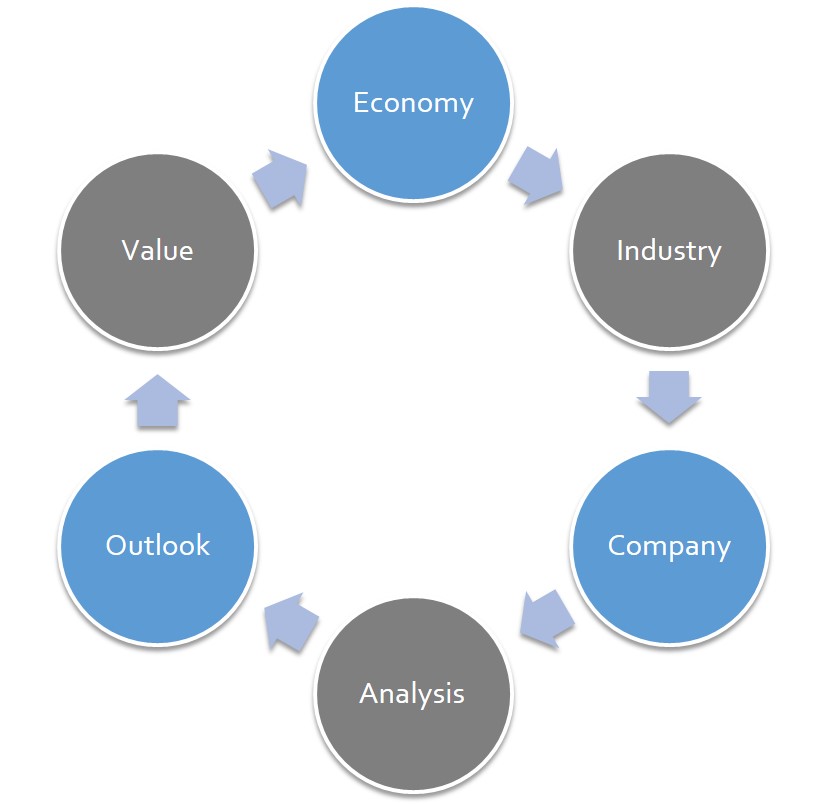

ARC has the most extensive fundamental independent research coverage in Canada. To narrow our universe of stocks, we employ quant screens and factor-based screens to help identify potential investments. But quant screening is not enough. It's backwards looking, doesn't adjust well to incorporate forward-looking information, and simply can't adjust for other factors such as management interpretation of loose accounting rules. While quant analysis is good for generating potential ideas, all the important work comes afterwards through fundamental forward-looking analysis. By reviewing macroeconomic factors, industry trends and company-specific issues, we assess each firm's forward-looking potential, looking for growth and sustainability in adjusted cash flows to support value. While other research firms may incorporate fundamental analysis, it's what we do afterwards that ensures that our interests are completely aligned with yours, making us unique in the Canadian market.

Next Step: Independence Screen