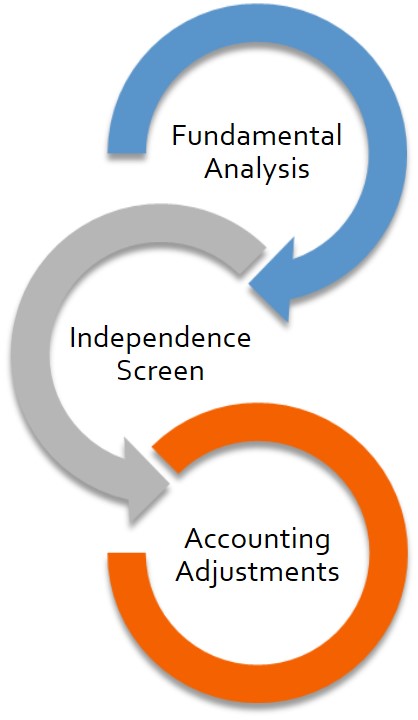

Our Three-Stage Process Is Based in Fundamental Research

Our Three-Stage Process Is Based in Fundamental Research

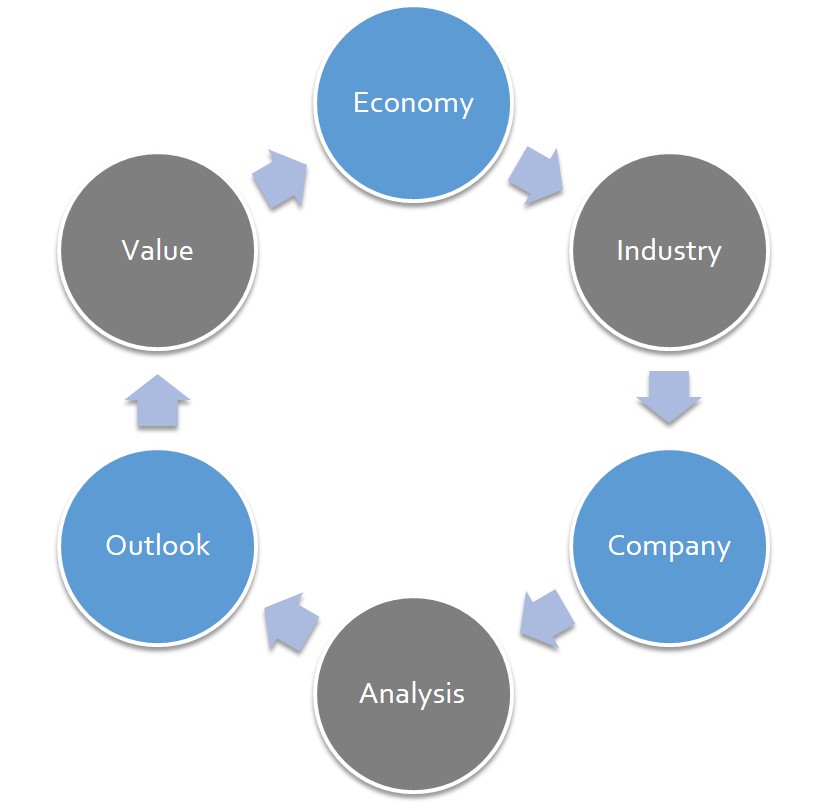

Fundamental Analysis: To narrow our universe of stocks, we employ quant screens and factor-based screens to help identify potential investments. But quant screening is not enough. It's backwards looking, doesn't adjust well to incorporate forward-looking information, and simply can't adjust for other factors such as management interpretation of loose accounting rules. While quant analysis is good for generating potential ideas, all the important work comes afterwards through fundamental forward-looking analysis. By reviewing macroeconomic factors, industry trends and company-specific issues, we assess each firm's forward-looking potential, looking for growth and sustainability in adjusted cash flows to support value. While other research firms may incorporate fundamental analysis, it's what we do afterwards that ensures that our interests are completely aligned with yours, making us unique in the Canadian market.

Independence Screen: Unfortunately, investment banking activity taints most of the research available from the sell-side. Our analysis shows that companies are 40% more likely to be rated as a Buy by brokers that are receiving fees from those same companies for underwriting services. ARC is free from any outside influence. As part of our value-added process we screen out the companies that we think receive more favourable recommendations due to investment banking activity and other conflicts of interest.

Forensic Accounting Analysis: We validate the integrity of the financial statements because confidence in the numbers behind your investments is paramount. If investors can't trust the numbers behind the research or quant-based process that they're using, it doesn't matter what industry, sector or company is being analyzed. We delve deep into the financial statements to flush out potential threats, and also to identify investment opportunities hidden by complex or inadequate financial reporting.

Factor Screening + In-Depth Fundamental Analysis

ARC has the most extensive fundamental independent research coverage in Canada. To narrow our universe of stocks, we employ quant screens and factor-based screens to help identify potential investments. But quant screening is not enough. It's backwards looking, doesn't adjust well to incorporate forward-looking information, and simply can't adjust for other factors such as management interpretation of loose accounting rules. While quant analysis is good for generating potential ideas, all the important work comes afterwards through fundamental forward-looking analysis. By reviewing macroeconomic factors, industry trends and company-specific issues, we assess each firm's forward-looking potential, looking for growth and sustainability in adjusted cash flows to support value. While other research firms may incorporate fundamental analysis, it's what we do afterwards that ensures that our interests are completely aligned with yours, making us unique in the Canadian market.

Independent and Trustworthy Analysis

Unfortunately, investment banking activity taints most of the research available from the sell-side. Our market analysis shows that companies are 40% more likely to be rated as a Buy by brokers that are receiving fees from those same companies for underwriting services.

Sell-side analysts also give favourable ratings and target price to companies to stay on the good side of company management. Sell-side analysts rely on these relationships to organize industry conferences and non-deal roadshow meetings between institutional investors and company executives.

ARC is free from any outside influence. As part of our value-added process we screen out the companies that we think receive more favourable recommendations from sell-side analysts due to investment banking activity and protecting relationships with company executives.

Forensic Accounting Analysis

At ARC, we validate the integrity of the financial statements because confidence in the numbers behind your investments is paramount. If investors can't trust the numbers behind the research or quant-based process that they're using, it doesn't matter what industry, sector or company is being analyzed. We delve deep into the financial statements to flush out potential threats, and also to identify investment opportunities hidden by complex or inadequate financial reporting.

Forensic accounting investment analysis cannot be accomplished by simply reading publicly-available financial statements and looking for accounting issues. Every investment analyst and portfolio manager already does that. Forensic accounting is the in-depth analysis of internal financial documents (audit working papers, accounting ledgers, internal correspondence). These documents are only available as part of the discovery process in litigation matters, and are not available to the public. Internal documents cannot be used to directly analyze a company. That would be illegal. In addition, most forensic cases only reach litigation and discovery once a company has already imploded (which is far too late for investors). Instead, forensic accountants build their expertise by examining numerous high-profile implosions from the inside out. By seeing how troublesome accounting issues work from the ground-up, forensic accountants learn to identify the red flags that existed in the public financial statements before the company experienced trouble. These red flags are then used by the investment team to search for potential problems in other public companies.

Many forensic accounting cases involve in-depth disputes over the acceptability of certain management choices allowed within the accounting rules. Only real forensic accountants with years of involvement in litigation cases can know the extent to which the accounting rules are being stretched by companies.

Having access to directly-sourced forensic accounting knowledge is a valuable line of defence against the threats and exposures that can negatively impact a portfolio. Just as important, this knowledge can steer clients through 'accounting noise' that sometimes gets attributed to otherwise attractive companies. ARC is the only independent research firm in North America that built its forensic accounting expertise through direct knowledge of numerous high-profile Canadian investment collapses.